Squinting at the Light at the End of the Tunnel

by Jeff Lambert | Other Voices

This is the time of year when wealthy individuals begin to consult with their accountants and financial advisers to assess how their investments have performed in the past 12 months. Although financial advisers are rarely advocates for spending, this year may reveal a modest exception.

A few potential clients with recovered investment capital are ready to allocate a bit of their money to re-boot dormant or deferred projects. These individuals are, just now, receiving news from their advisers. And these individuals may, in turn, begin to call you to revive dormant projects, or to discuss new projects that might begin in 2011.

We now have the Thanksgiving holiday behind us, and we are closing in on the end of Q4 2010. There may be ups and downs in the stock market but, barring any embarrassing Wiki-leaks involving the Bank of America, the year’s financial performance is all but over. All that remains is the writing of reports documenting the year’s financial story. Attention is now focused on holiday-driven retail performance and consumer spending.

This is the time of year when wealthy individuals begin to consult with their accountants and financial advisers to assess how their investments have performed in the past 12 months. Although financial advisers are rarely advocates for spending, this year may reveal a modest exception. Losses sustained by investors since December 2007 have been made almost whole again – even if the profit has not been realized, at least the invested principal.

Here are a few statistics that indicate the wealthy are in the mood to spend money:

- Hermes, the French luxury leather goods manufacturer and retailer, has already announced that 2010 is the most profitable year in their six-generation history.

- Neiman Marcus San Francisco hints that their retail sales are already 17 percent ahead of what they were at this time last year (2009).

- San Francisco’s Emporio Armani is closing its popular café at the end of this year to, one would imagine, create more retail space.

- BMW, Mercedes-Benz and Audi are curtailing year-end vacations and increasing the lengths of worker shifts to accommodate a steep, year-end increase in orders of luxury automobiles.

- And Wal-Mart has reported a 9.3 percent increase in quarterly profits (the battered middle class has stepped down a notch and is shopping more frequently at discount stores)

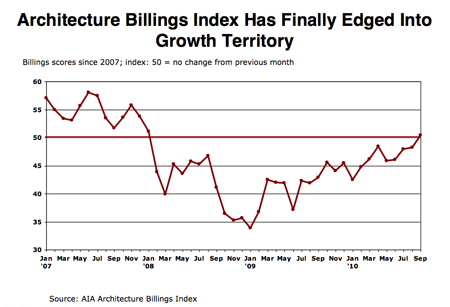

How does this information affect the architectural and allied design professions? For one thing, wealthy individuals have more than two years’ worth of pent-up demand for design services. The upper middle class has stashed away savings and are looking at spending strategies. Since banks are not lending with great ease to consumers, a few potential clients with recovered investment capital are ready to allocate a bit of their money to re-boot dormant or deferred projects. These individuals are, just now, receiving news from their advisers. And these individuals may, in turn, begin to call you to revive dormant projects, or to discuss new projects that might begin in 2011.

Which market sectors will benefit most from this new (albeit modest) willingness to spend money? Certainly the very high end of the single family residential market is seeing new life. Sales of $10 million houses are up, and inventory in this stratum is down. The market sector just below is seeing similar, if less vigorous, sales figures.

Renovation and remodeling projects are picking up, although the most recent data indicates that these projects are smaller and of lower construction value. For the most part, these projects are paid for in cash. Fees for design services are often lower, too, as a result of lower construction value (and value-driven clients). Fee erosion is an issue across all market sectors, but that is a separate issue.

According to Reed Construction Data, the projected growth rate for construction in 2011 is 3 percent across all market sectors, across all regions in the USA. Most of that growth is expected in the second half of the year. The first half of the year may well be close to flat but it is anyone’s guess. The bright spot in this gloomy forecast is that the Bay Area is one of five regions in the country that is expected to see growth that is double the national rate. (The others are Los Angeles, New York, Boston and Washington, D.C.) The single family residential market may see greater growth than that, with a projected growth rate of about 10% over last year.

Follow this link to a downloadable PowerPoint produced by Reed Construction Data, in collaboration with the Associated General Contractors and the AIA. The presentation is a great resource of projections and comparative data regarding design and construction across all regions, market sectors, material costs and employment. I suggest you quickly flip through it to identify projections for your specific market sectors.

Architects and interior designers should see this as an opportunity to refresh the list of key contacts and clients with dormant or deferred projects. Call or email them. Ask clients if they have news that might motivate them to resume progress on the project. If you are a landscape architect, structural engineer or general contractor (for example), contact architects whom you know to have projects on indeterminate hold. If possible, ask them if they have checked in with their clients. Develop and hone the ability to detect signs that clients are receiving good news from the people that manage their money.

I hope that your see your prospects trending towards “positive”. Maintain an optimistic outlook. Most importantly, do not wait for the telephone to ring or for that email to arrive. Make this the year that you commit to an increase in weekly or daily business development, because 2011 will be the year in which there will be a noticeable increase in business to develop.